At WC Vendors, we’re often asked questions about marketplace payments. One of the most common queries is, “Which payment gateway is supported?” to which the quick answer is, “All WooCommerce gateways are supported.” Another one is, “How do I pay my vendors?”

Typically, confusion surrounds the two kinds of marketplace payments:

- Payments from customers for orders

- Payouts to vendors for their earnings (commissions)

Whether you should perform these payments simultaneously or separately is usually where the confusion stems from.

How and when you pay your vendors is a business and technical decision. You’ll need to learn how to configure your marketplace payments, policies, and procedures. You’ll have to determine whether to pay your vendors instantly or after customers have placed orders. In addition, you must figure out if you should implement a regular vendor payment schedule that operates weekly, monthly, or quarterly.

Today, we’ll discuss essential details about marketplace payments. So let’s get right to it!

The 2 Types Of Marketplace Payments

When learning about payments in your online marketplace, the best place to start is the two types of marketplace payments.

1. Payments from Customers

Whenever a customer places an order, they pay for it at checkout.

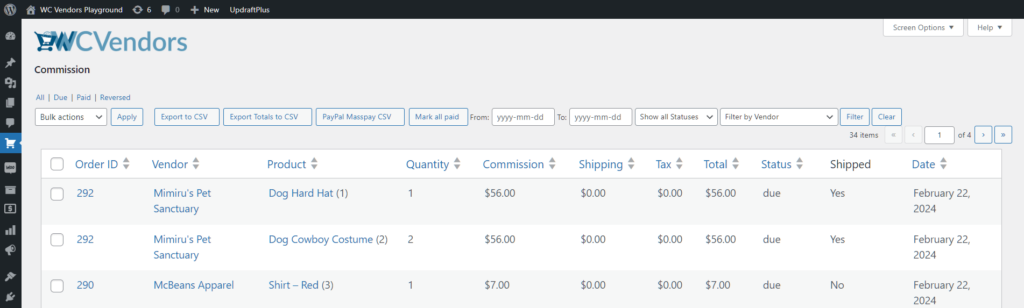

You can use any WooCommerce payment gateway to process the customer’s payment. This logs your vendors‘ earnings into the commission table, which lists said earnings as “due.” This means that you haven’t paid them yet.

Payment flow explained

- A customer browses your marketplace and adds products to their cart.

- They proceed to checkout where they’re provided a list of payment gateways (such as Stripe Connect) to process payments.

- They pay with their credit card and the order is marked as “processing” or “completed.”

- When the payment is confirmed, the system is triggered to calculate the earnings (commissions) due for the vendor(s). Furthermore, said due earnings are noted down on the commission table.

- The transaction with the customer is completed.

- Your account reflects the payment for the total order.

Now that you’ve received the customer’s payment, you must pay your vendors the money you owe them.

2. Payouts to Vendors

Once a customer has paid for their order, you’ll owe a commission to the vendor for the product(s) in that order. How you pay this vendor is up to you, with your chosen method depending on how and when you want to make the payment.

When it comes to paying vendors, you have two payment methods available:

i. Use the marketplace’s payment system to pay your vendors

Using the multi-vendor marketplace payment system limits your options to supported gateways and payout systems. These payment gateways are required to support split payments to be compatible with a solution for marketplace payments.

ii. Use external systems to pay your vendors

This method comes with no limits regarding how you pay your vendors. WC Vendors allows you to export all vendor commissions, which creates a list of the payments you must make. You can then pay your vendors via bank transfers, checks, scheduled payments, or cash.

Receiving And Making Marketplace Payments

Now, it’s time to tackle the processes of receiving customer payments and making vendor payments.

1. Receiving payments from customers

First, let’s answer another frequently asked question: “Can customers pay vendors directly?”

Generally speaking, no, customers can’t pay your vendors directly. They can’t skip payment processes the way eBay does, either. WC Vendors is limited by the WooCommerce gateway API, which isn’t built for direct payments.

Payments can be split between the marketplace and vendors using the vendor-compatible gateways listed below. However, all payments must initially be processed through the marketplace and then distributed, even if the entire payment is destined for the vendors.

Payment gateways for customers

Over 100 payment gateways exist for WooCommerce, and this list gets longer every day. You can use any WooCommerce-compatible payment gateway with WC Vendors. This allows you to accept payments for customer orders from anywhere in the world.

Payment gateways for WordPress that support payments from customers and payouts to vendors alike include:

- Stripe

- PayPal

2. Paying your vendors

How and when you want to pay your vendors defines your payment solution.

Two methods are available: paying your vendors instantly or paying them on a schedule. Which one you pick is a business decision you must make.

i. Paying a vendor their commission instantly once the customer completes a purchase

Advantages

- Saves time

- Pays vendors instantly

- Enhances convenience for both vendors and the marketplace

- Eliminates the need to manually track and disburse payments to vendors

Disadvantages

- Restricts the available payment solutions

- May potentially cause complications with refunds and disputes

- Requires trust in vendors’ product delivery

- May entail responsibility for resolving disputes

ii. Paying vendors on a schedule or manually

Advantages

- Allows verification that vendors have shipped their products before disbursing their commissions

- Reduces fees associated with payment transfers

- Lets you effortlessly pay your vendors in bulk through your preferred payment method

- Enables you to tailor payment methods for each vendor individually

- Allows use of any preferred payment gateway of your choice

- Streamlines dispute resolution processes with customers

Disadvantages

- Increased workload for your business in tracking and remunerating vendors

- Vendors might find your payout schedule inconvenient

Most marketplaces pay their vendors on a schedule, as this grants them far greater control over their business.

Marketplace Payment Solutions for your Vendors

Handling marketplace payments efficiently is key to running your marketplace smoothly. The right payment solutions make sure vendors get paid on time, reduce accounting work, and improve the overall experience for both vendors and customers.

Here are some good payment solutions you can use:

- WC Vendors Stripe Connect

- Payouts for WC Vendors

- MangoPay WooCommerce

- Escrow for WooCommerce

- Mollie Connect for WC Vendors

- Square Payment for WC Vendors

- PayPal Multi-Account for WooCommerce

Knowing the different payment solutions available is important for you and your vendors. Each option offers different features, benefits, and limitations. For example, some payment methods work well for international transactions, while others offer strong fraud protection or easy links to accounting systems.

Different vendors have different needs. Some need quick payments, others want secure transactions, and some might deal with multiple currencies. Offering a range of payment options can meet these various needs, leading to happier vendors. When vendors find a payment solution that works well for them, they are more likely to stay with your marketplace. This helps your marketplace grow and succeed.

In short, exploring and understanding these payment solutions is not just nice to have, it’s necessary. It helps build trust, makes everything more efficient, and supports the growth of your platform.

If you want to know more about these payment solutions, check out this comprehensive article: How To Select The Best Marketplace Payment Gateways.

Conclusion

Marketplace payments are a crucial aspect of any multi-vendor marketplace. After all, they allow you to collect payments from your customers and give your vendors the commissions they’re due.

To master marketplace payments, familiarize yourself with the following concepts:

Do you have any questions about marketplace payments? Reach out to us and let us know; we’d be happy to hear from you!