Managing vendor payouts in a multi-vendor marketplace can seem tricky, but it doesn’t have to be. Paying your vendors on time is important for keeping them happy and your marketplace running well.

In this article, we’ll share some easy tips for handling vendor payout effectively. We will also highlight useful features offered by platforms like WC Vendors.

Keep reading to see how you can make vendor payout a seamless part of your business!

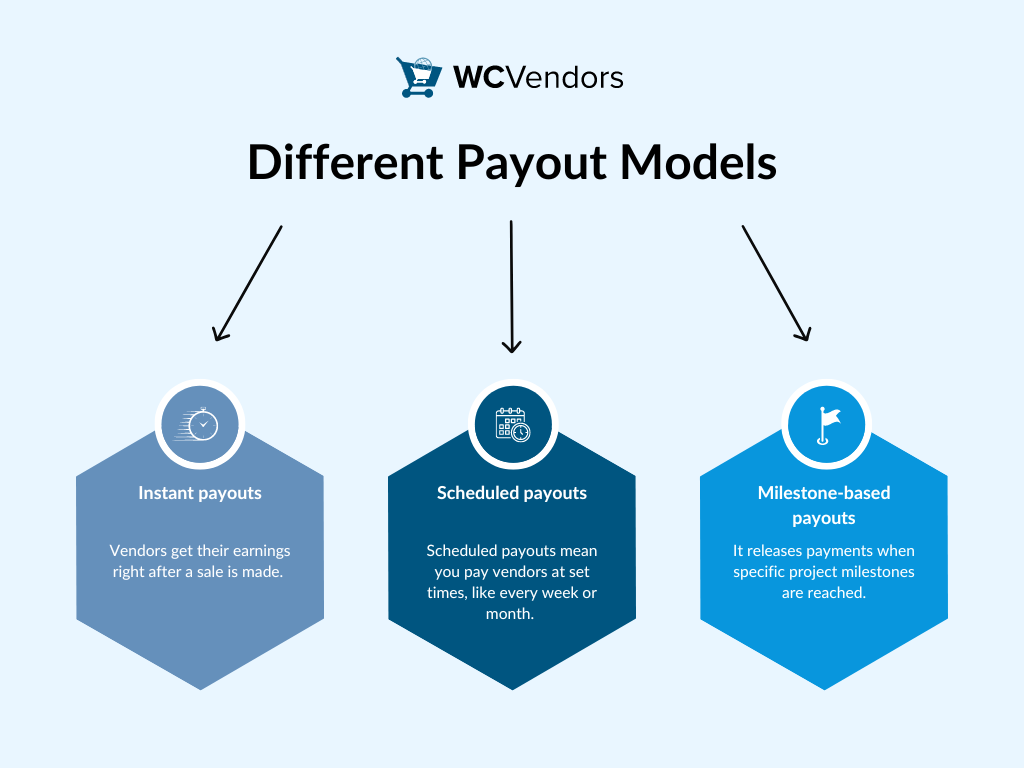

Understanding Different Payout Models

First, let’s explore the different vendor payout models available for your multi-vendor marketplace.

Understanding these models will help you decide which one suits your marketplace best. Specifically, vendor payout models include instant payouts, scheduled payouts, and milestone-based payouts. But which one is right for you and your vendors?

- Instant payouts: In this model, vendors get their earnings right after a sale is made. While this is great for vendor satisfaction, it might strain your cash flow.

- Scheduled payouts: Scheduled payouts mean you pay vendors at set times, like every week or month. This helps in better cash flow management and allows for easier tracking of payouts.

- Milestone-based payouts: This model is best for service-based marketplaces. It releases payments when specific project milestones are reached. This way, you ensure that work is completed as planned.

Choosing the right vendor payout model is fundamental to your marketplace’s success. Platforms like WC Vendors offer these models, making it easier to manage vendor payouts efficiently.

Now that you understand the different payout models, it’s time to set clear payout terms and conditions to ensure everyone is on the same page. Let’s dive into it!

Setting Clear Payout Terms And Conditions

Clear communication is key for any multi-vendor marketplace. Setting clear rules for vendor payouts helps avoid confusion and arguments.

Vendors need to know when and how they will get paid. These rules should be explained in the vendor agreement and shown again in the vendor dashboard. Consequently, clear rules build trust and maintain a professional relationship with your vendors.

Here are some key vendor payout terms and conditions to consider:

- Payout schedule: Specify when vendors can expect payments (e.g., weekly, bi-weekly, or monthly).

- Minimum payout amount: Set a minimum threshold to avoid frequent small transactions.

- Payment methods: Outline available payment options, such as bank transfers or PayPal.

- Transaction fees: Clearly outline any fees deducted from vendors’ earnings.

- Payment criteria: Define any criteria that must be met for payouts, such as minimum sales or completed transactions.

- Dispute resolution: Include guidelines on how disputes will be handled.

- Penalties for breach of contract: Define any penalties for not meeting agreed-upon terms.

Setting clear payout terms and conditions ensures that all parties are on the same page and helps to avoid misunderstandings. However, to truly streamline the payout process and reduce manual errors, implementing automated payout systems is essential.

Let’s explore the benefits of automation in the next section—read on further!

Implementing Automated Payout Systems

Automation is a big help in managing a multi-vendor marketplace. Therefore, implementing automated vendor payout systems can save time, reduce errors, and streamline operations. By automating these processes, you ensure consistency and reliability, thus making your marketplace more professional.

Steps to automate vendor payouts in your marketplace

1. Install payment gateway plugin

- First, install and activate a payment gateway plugin (e.g., PayPal, Stripe) to facilitate vendor payouts.

2. Configure payments

- Next, go to your marketplace dashboard and navigate to the settings for payments. Then, set the payment schedule (weekly, bi-weekly, monthly) to automate vendor payout timing. By doing this, you streamline the payout process and ensure timely payments.

3. Enable payment methods

- After that, go to your settings for payment methods. Enable and configure the desired payment methods for seamless vendor payout processing.

4. Enter API Credentials

- For payment gateways like PayPal or Stripe, simply enter the needed API credentials in the settings. This step ensures your vendor payouts are secure and accurate. Additionally, it’s straightforward and helps keep everything running smoothly.

5. Enable payout reports

- Turn on detailed payout reports and notifications in your marketplace settings. This feature also gives you clear insights into vendor payouts, making it easier to track and manage them.

These systems provide detailed reports, making it easier for you to track and manage vendor payouts. Imagine how much time you could save!

Now that you have automated vendor payouts, it’s crucial to maintain transparency with your vendors. Let’s explore the best practices for ensuring transparency with vendors!

Ensuring Transparency With Vendors

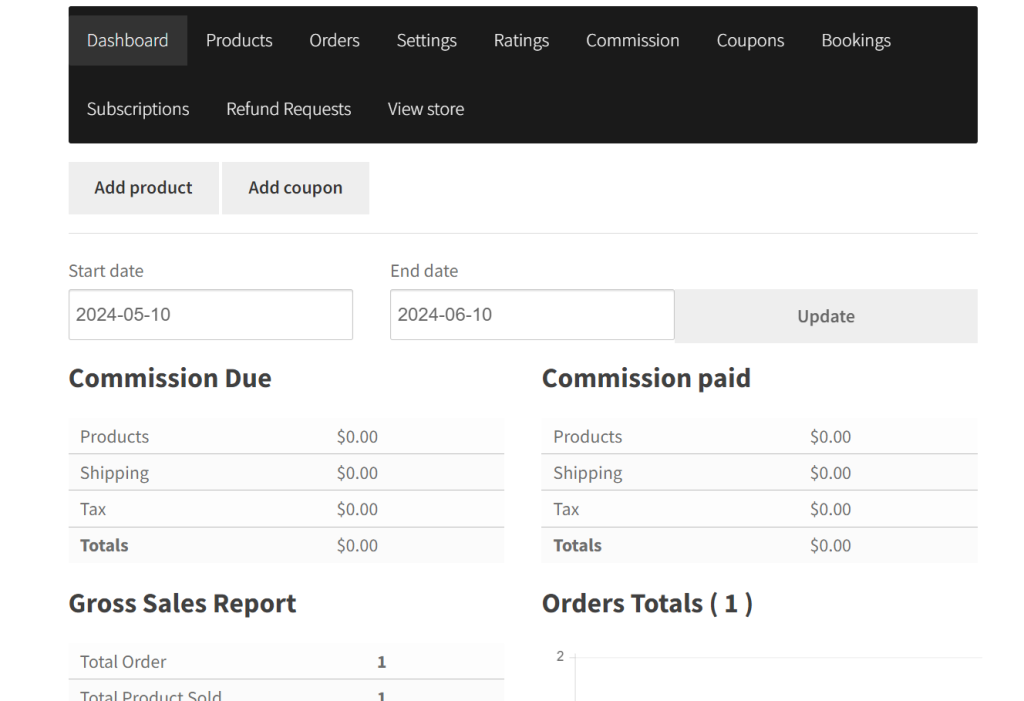

It’s crucial to be transparent in vendor payouts to maintain trust and credibility. Therefore, vendors should have access to clear reports that show their earnings, any fees deducted, and their payout history. Consequently, this transparency helps vendors understand their earnings and feel assured they are being paid fairly.

Consider offering a vendor dashboard where vendors can see up-to-date information on their sales and payouts. Additionally, regular communication and detailed reports foster a transparent relationship with your vendors. So, let’s discover more ways to improve transparency!

Now, let’s move on to managing international payouts. Let’s explore the best practices for handling payouts across different countries.

Managing International Payouts

Many multi-vendor marketplaces involve vendors from various countries. Handling international vendor payouts can be tricky due to different currencies, banking systems, and regulations. However, with the right tools and partners, these challenges can be managed effectively.

To manage international vendor payouts successfully, consider these steps:

- Choose reliable payment gateways: Opt for payment gateways that support multiple currencies and have a global reach.

- Stay updated on regulations: Make sure you understand the banking and tax regulations in the countries where your vendors are located.

- Automate payouts: Use software that can automate payouts, reducing the risk of errors and saving time.

- Regularly communicate: Keep vendors informed about payout schedules and any changes that might affect them.

- Offer support: Provide resources and customer service to help vendors with any payout-related issues.

For instance, WC Vendors offers features like multi-currency support, automated payouts, and seamless integration with popular payment gateways. This makes it easier for marketplaces to handle international vendor payouts efficiently. By following these steps and utilizing tools like WC Vendors, you’ll be better equipped to manage a diverse group of vendors globally.

Isn’t it reassuring to know you have experts handling these complexities?

Now, let’s explore how to monitor and reduce payout delays, ensuring an even smoother experience for your vendors. Read on further!

Monitoring And Reducing Payout Delays

Payout delays can lead to vendor dissatisfaction and a loss of trust. Therefore, it’s essential to regularly monitor your payout process to identify and address any bottlenecks. WC Vendors helps you use key performance indicators (KPIs) to measure the efficiency of your payout system.

To monitor and reduce vendor payout delays, start by using analytics tools to track how long it takes for payouts to reach vendors. Next, set realistic expectations by communicating payout timelines to vendors. Additionally, implement buffer periods to handle any unexpected delays in the payment process.

Automate notifications to keep vendors informed about any delays and provide updates on payout status. Finally, regularly review your payout processes to find and fix any inefficiencies. Monitoring vendor payouts closely helps ensure smooth and timely transactions.

Implementing automated systems and having a clear payout schedule can significantly reduce delays. Moreover, timely payouts keep your vendors happy, which in turn benefits your marketplace. So, if you want to keep your vendors on your side, timely and reliable payouts are key!

Next, let’s explore how to address vendor payout disputes effectively to ensure fair resolutions.

Addressing Vendor Payout Disputes

Disputes over payouts can arise, and it’s crucial to handle them professionally and efficiently. First, establish a clear dispute resolution process that vendors can follow if they have issues with their payouts.

- Acknowledge complaints promptly: Respond to vendor concerns quickly to show that you take their issues seriously.

- Investigate thoroughly: Review the details of the dispute and gather all necessary information before making a decision.

- Communicate clearly: Keep the vendor informed throughout the resolution process. In addition, provide a clear explanation of the outcome.

By addressing disputes fairly and transparently, you maintain trust and professionalism within your marketplace.

To prevent such disputes from arising, it’s also essential to regularly review and update your payout policy. Let’s explore how to keep your policies current and effective—read on!

Regularly Reviewing And Updating Your Payout Policy

The business environment is always changing, and your vendor payout policy should also change too. Regularly review and update your policy to keep it effective and fair.

Collecting feedback from your vendors is crucial in this process. Vendors are on the frontline and their insights can help you find areas that need improvement. For example, they may suggest faster payout processes or more transparent fee structures. Addressing these points improves satisfaction and retention. When vendors feel treated fairly, their loyalty increases.

Staying competitive is another significant advantage of regularly updating your vendor payout policy. A responsive and up-to-date policy can attract more vendors and customers. This happens by meeting current market standards and demands. A proactive approach helps you foresee potential issues. Addressing them before they become problems ensures smooth operations.

In this context, platforms like WC Vendors offer invaluable tools that simplify the management and updating of your payout policies. Moreover, these platforms often feature automated payouts, detailed reporting, and customizable policy settings. Utilizing these tools can help you stay ahead of changes, making it easier to maintain an efficient operation.

Conclusion

By following best practices in vendor payout management, you can build a more effective multi-vendor marketplace. The right approach not only benefits your vendors but also strengthens your platform.

Smooth and efficient vendor payouts enhance vendor satisfaction and improve your marketplace’s reputation. Start implementing these strategies today to see a positive impact on your business operations.

To recap, successful vendor payout management involves:

- Understanding different payout models

- Setting clear terms

- Implementing automation

- Ensuring transparency

- Managing international payouts

- Reducing delays

- Resolving disputes promptly

- Regularly updating your payout policy

If you want to improve how you manage your vendor payouts, get in touch with us. We’re ready to help you improve your marketplace operations!