The WC Vendors Tax plugin automates tax calculations using popular tax calculation services. It automatically uploads orders and refunds to your chosen tax calculation service. Currently, we support the following services:

- Tax Jar – TaxJar: Sales Tax Compliance for Modern Commerce

- Avalara– Tax Compliance Software – Avalara

If you have a preference and it’s not in our integrated options, please reach out to us via our support form, and we’ll submit a feature/integration request for you.

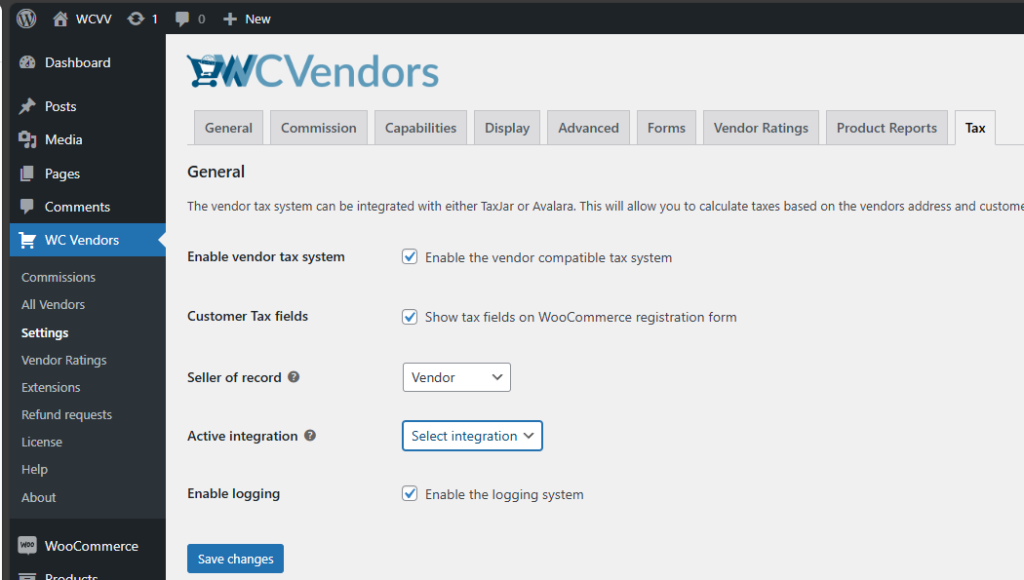

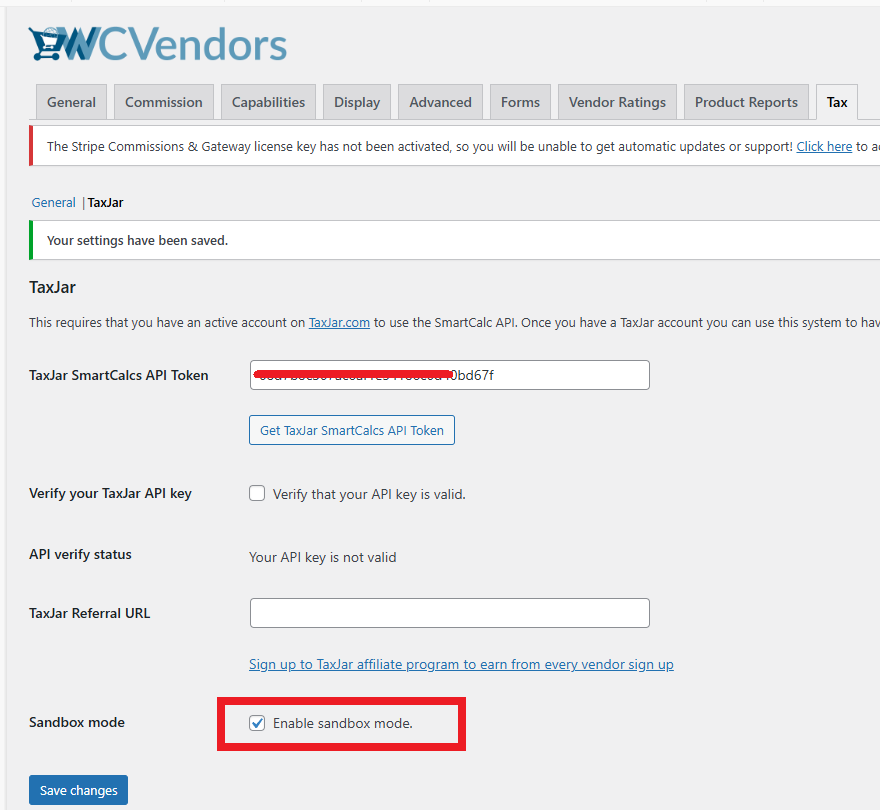

Now, after you install the plugin, you can go to WC Vendors > Settings > Tax, view the settings, and set things up:

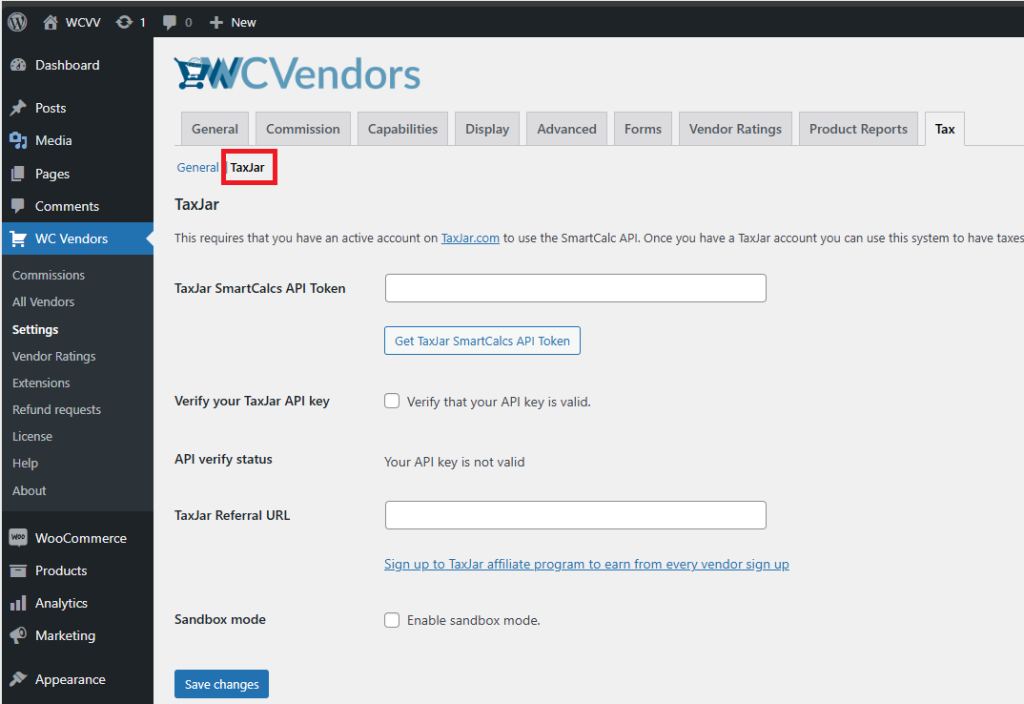

It’s important to choose an Active Integration first. For this getting started guide, we’ll use TaxJar. Once that’s done, save the changes. After saving, you’ll see a small submenu next to General.

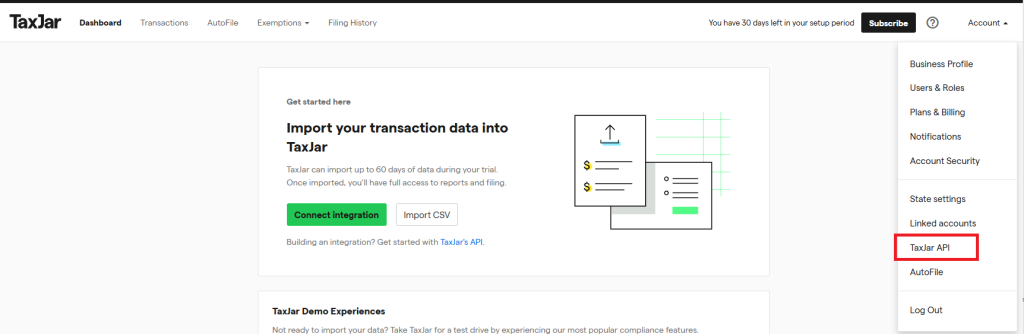

You will need an active TaxJar account, On the dashboard click Account > TaxJar API

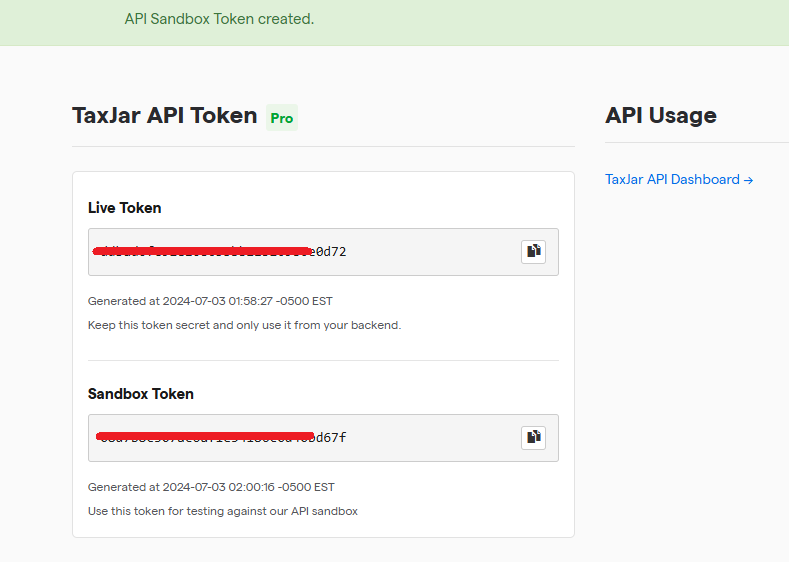

Here you can get your API token for a live or sandbox(testing)

Now copy the appropriate API Token and paste it on your settings. Note that if you are using the Sandbox Token you’ll want to enable the Sandbox mode option in WC Vendors

Now for the TaxJar Referral URL, it can be set so you earn a commission when a vendor signs up for their TaxJar account.

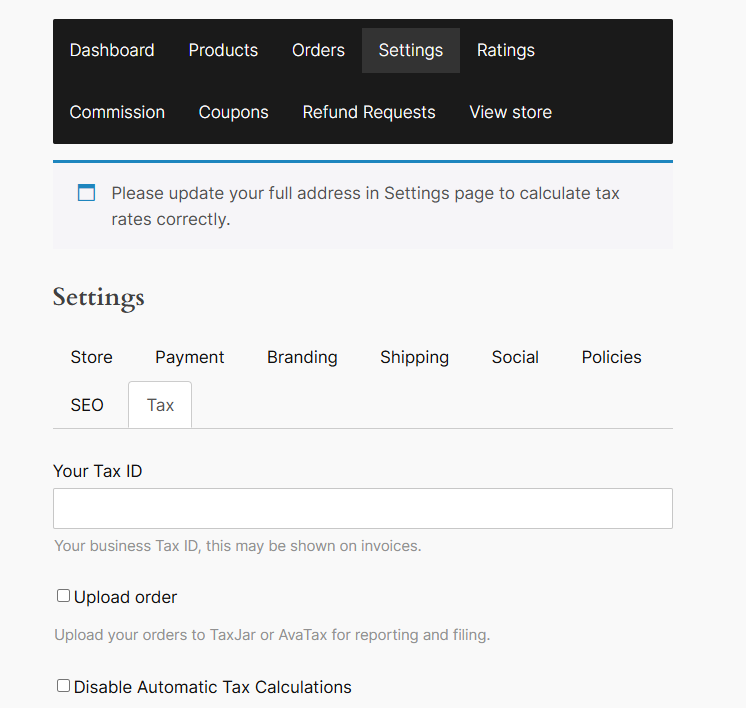

For the vendors, they can set up their TaxJar account on the Pro Dashboard page

The vendor process is quite similar to this guide but for their account/API token instead of yours 🙂 It’s also worth noting that Avalara follows a similar process