If you’re building a WooCommerce marketplace, payment infrastructure is a critical part of your success. Stripe for marketplaces is one of the most reliable options for collecting customer payments, splitting funds, and sending vendor payouts—all while staying compliant.

The tools are mature, the global reach is extensive, and the setup process is well-documented, especially when paired with platforms like WC Vendors. Stripe isn’t just used by startups, it powers major marketplaces at global scale.

This article outlines the top 10 reasons Stripe remains the preferred option for marketplaces of all sizes. Each section answers a common question, shares implementation context, and highlights how Stripe supports both operators and vendors.

So, let’s get started!

What Is Stripe For Marketplaces?

Stripe is a popular marketplace payment processor that helps businesses accept payments online. It’s known for being secure, fast, and easy to use. Stripe offers powerful tools that can be customized to fit your business needs. This makes it perfect for multi-vendor marketplaces.

One of the best things about Stripe for marketplaces is that it handles everything related to payments. It can collect Stripe marketplace payments from customers and split them between vendors. This simplifies the financial side of running a marketplace.

Whether your business is local or global, Stripe’s system makes transactions smooth. Plus, its strong security features keep both buyers and sellers safe.

Why Is Stripe For Marketplaces Ideal For Your Business?

1. Marketplace-ready integration with Stripe Connect

Stripe Connect is Stripe’s solution for multi-vendor platforms. Stripe Connect for marketplaces allows to create connected accounts for vendors, collect customer payments, apply platform fees, and pay out sellers automatically or on schedule.

Additionally, Stripe is compatible with both custom platforms and tools like WC Vendors and WooCommerce. This makes it accessible whether you’re a developer or using an off-the-shelf marketplace builder.

How do you connect Stripe to your marketplace?

There are several ways:

- WC Vendors’ native Stripe integration and onboarding wizard

- Official plugins and WooCommerce tools

- Use the Stripe API to create custom onboarding, charge handling, and fee distribution flows

Connected accounts can be created as standard, express, or custom, depending on how much control and branding your platform needs. All account types are fully compliant with regional KYC and tax laws.

If you’re using WC Vendors, Stripe Connect Integration is simple. The plugin offers built-in compatibility with Stripe, making the setup fast.

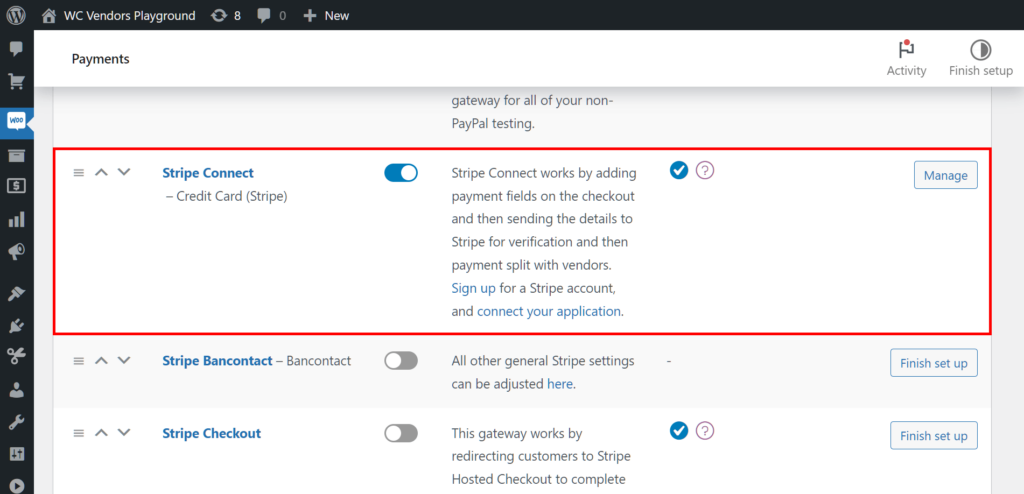

Once installed, go to the “Payments” section in WC Vendors and select Stripe as the payment gateway. With just a few clicks, you can configure Stripe to handle vendor payments.

2. Stripe supports a wide range of payment methods

Stripe supports over 135 currencies and more than 40 payment methods. This ensures that your marketplace can serve both local and international buyers using their preferred ways to pay.

These include:

- Cards (Visa, Mastercard, Amex)

- Wallets (Apple Pay, Google Pay)

- Bank methods (ACH, SEPA, iDEAL)

- Buy now, pay later options (Affirm, Klarna)

- Local methods specific to regions (FPX, Boleto, Alipay)

Why is this important for your marketplace?

When customers can choose familiar payment methods, conversion rates tend to improve. Vendors benefit from being able to receive funds in their local currency, and Stripe automatically handles currency conversion when needed.

3. Stripe provides built-in security and compliance tools

Security is a core feature of Stripe. The platform is certified to PCI DSS Level 1, and uses a range of technologies to detect and prevent fraud. For marketplace operators, this means fewer chargebacks, less manual review, and a more trustworthy experience for both buyers and vendors.

What specific protections does Stripe offer?

- Encryption for all data at rest and in transit

- Two-factor authentication (2FA)

- Strong Customer Authentication (SCA) support

- Real-time alerts and fraud detection via the Stripe Dashboard

- Integrated tools like Stripe Radar to block high-risk transactions

All of this helps your marketplace stay compliant with global regulations, including GDPR and CCPA.

For marketplaces using WC Vendors, this integration ensures all transactions are protected. Stripe’s built-in security tools work alongside WC Vendors to give both the marketplace owner and vendors peace of mind.

This means you can focus on growing your business without worrying about the safety of your transactions.

4. Stripe automates finance and reporting for marketplaces

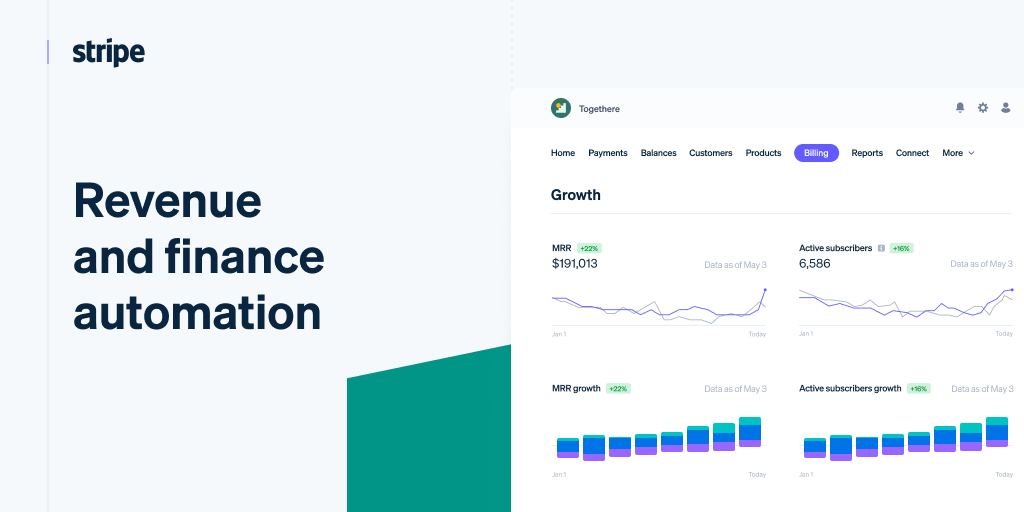

One of the most overlooked benefits of Stripe is how much it simplifies financial operations. With built-in finance automation, marketplaces can eliminate manual reconciliation, reduce bookkeeping tasks, and monitor vendor earnings at scale.

What finance automation tools are available?

- Real-time transaction tracking

- Exportable reports for sales, fees, and refunds

- Scheduled vendor payouts

- Tax form generation (e.g. 1099-K in the US)

- SQL-level data access through Stripe Sigma

In WC Vendors, these features help automate vendor earnings and reduce administrative tasks. You can track marketplace performance in the Stripe Dashboard, and use that data to inform pricing and growth decisions.

5. Stripe supports international payouts with compliance

Stripe for marketplaces allows you to send payouts to vendors in over 40 countries. This makes it easier to grow your marketplace globally without needing to manage separate payment processors or bank integrations.

Can Stripe handle international vendors?

Yes. Stripe enables you to set payout frequency (manual, daily, weekly, or monthly), and supports deposits in local currencies. Vendors can manage their own settings, or you can control them through the platform.

Payouts are made to connected accounts, and Stripe ensures that local tax and KYC requirements are met in each supported region.

6. Automated vendor payouts

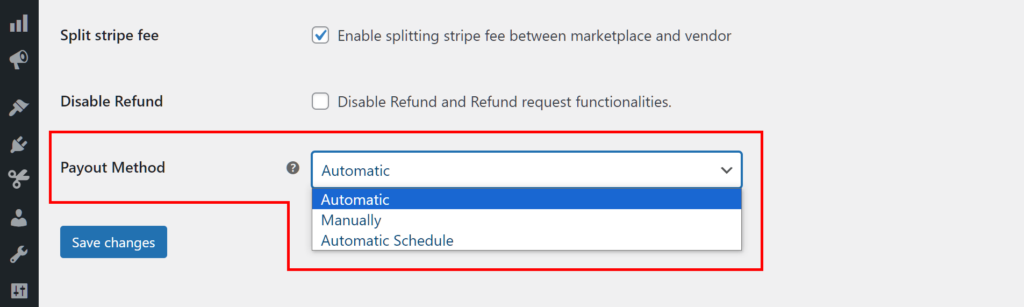

Managing vendor payouts can be time-consuming, but Stripe makes it easier with automated payouts. You can set up automatic transfers to vendors, ensuring they receive their earnings without delays. This feature simplifies the payout process, reducing manual work and administrative overhead.

If your marketplace is built on WC Vendors, this process is even more streamlined. Stripe can automate payouts to vendors through WC Vendors.

Stripe Automatic Payments allow you to schedule WooCommerce Stripe vendor payouts without needing to manually trigger them. This ensures vendors are paid on time, every time—building trust and reducing admin overhead.

You can set up payments to be sent at regular times. Vendors will trust that they’ll get paid on time. This also saves you a lot of time on admin tasks, which is especially helpful if you have a large marketplace with many vendors.

Can I use Stripe for Marketplaces to pay Vendors?

Yes, Stripe allows you to automate payments to vendors. This feature makes sure vendors get their money quickly and reduces your admin work. It makes the payout process easier and faster. With Stripe’s automation, you can spend more time growing your marketplace instead of handling payouts manually.

7. Built-in dispute management for marketplace sellers

Stripe includes tools to help vendors respond to chargebacks quickly and effectively. Sellers can upload evidence, view dispute statuses, and get notified in real-time—all within the Stripe Dashboard.

This reduces lost revenue and saves time. For marketplace owners, Stripe’s dispute-handling system ensures both sides are protected while keeping the buyer experience secure and fair.

8. Stripe Scales Alongside Your Marketplace Growth

Stripe’s infrastructure is built for scale. The same platform used by Shopify, Lyft, and Booking.com is available to marketplaces of all sizes. You can start with a few vendors and grow into a global platform without changing your payment provider.

How does Stripe support a growing business model?

- High-volume transaction support

- Rate-limited API calls with retry logic

- Dashboard insights for platform-level performance

- Transparent pricing based on volume and services used

If you’re using WC Vendors with WooCommerce, the same applies. Stripe adapts to your transaction volume automatically, and you don’t need to migrate to a new solution later.

9. Stripe payment links allow fast vendor checkout options

In some cases, vendors might not want to set up full storefronts. Stripe Payment Links are hosted checkout pages that can be created instantly for any product or service.

How do payment links work?

A vendor can create a product and generate a secure Stripe-hosted URL to accept payments immediately. No custom development is needed. This is ideal for:

- Single-product vendors

- Freelancers and service sellers

- Vendors in early-stage marketplaces

WC Vendors users can allow sellers to use links alongside regular storefront tools, giving them more flexibility to start selling quickly.

10. Developer-friendly tools and customization options

Stripe is known for its strong documentation and developer-first approach. For marketplaces that need more than just plug-and-play functionality, Stripe offers full access to customizable workflows through its APIs, SDKs, and webhooks.

What makes Stripe developer-friendly?

Stripe provides extensive tools that allow your team to build exactly what your marketplace needs:

- Well-documented REST APIs for payments, refunds, disputes, onboarding, and reporting

- Pre-built UI components for faster development (e.g. Stripe Elements)

- Webhooks for real-time updates on events like charges, failed payouts, and onboarding status

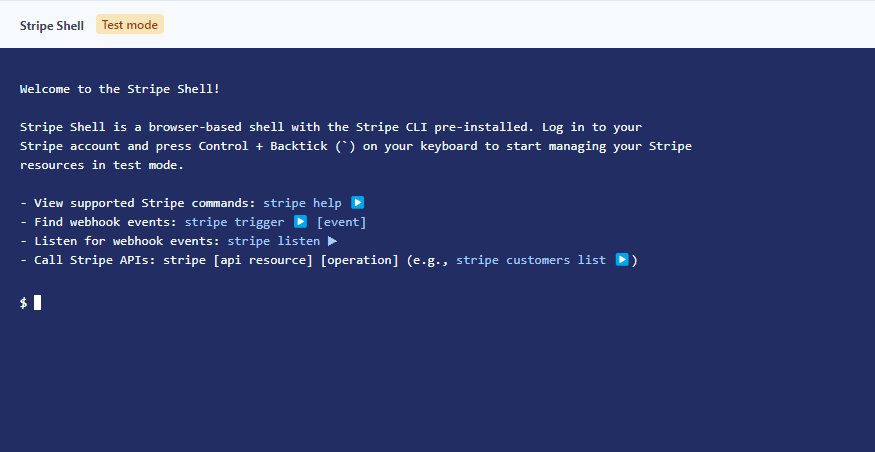

- Sandbox and test environments for safe testing before going live

Stripe also publishes technical best practices, SDKs for popular languages (JavaScript, PHP, Python, etc.), and open-source tools like Stripe CLI for local development and testing.

For marketplaces with in-house development or a technical partner, this means Stripe is flexible enough to support custom flows while remaining secure and compliant.

Even if you’re using WC Vendors and WooCommerce to manage your vendor relationships, having access to these tools can help your team go beyond default settings and tailor the experience to your specific marketplace model.

Conclusion

Stripe for marketplaces delivers a host of powerful benefits that boost your payment processes, enhance security, and give you the flexibility you need. It’s more than just a payment processor—Stripe is a game-changer that simplifies and strengthens how your multi-vendor marketplace operates.

By using Stripe, you can focus on what matters most: growing your marketplace and providing a seamless experience for your vendors and customers. If you’re ready to take your marketplace to the next level, Stripe is the solution to help you get there.

To make the most of Stripe for your marketplace, here’s what you need to remember:

- What is Stripe?

- Why is Stripe Ideal for Marketplaces?

- Easy Stripe Connect integration

- Flexible payment method options

- Strong built-in security and compliance

- Automated finance and reporting tools

- Global vendor payouts with local support

- Scheduled and automatic vendor payments

- Built-in Dispute Management

- Stripe scales with your growth

- Fast setup with Stripe Payment Links

- Full control through developer-friendly tools

Each feature contributes to a more reliable, efficient, and scalable operation. If you’re managing multiple vendors, Stripe helps you stay organized and compliant while saving time on finance tasks.

Want to start using Stripe with WC Vendors? See our pricing plans to find the right tools for your marketplace setup.

Frequently Asked Questions About Stripe for Marketplaces

What are the downsides of Stripe?

Stripe’s biggest downsides include account stability concerns, complex fee structures for certain regions, and limited support in some countries. While reliable overall, some users report account freezes due to risk detection or compliance checks. This is why staying compliant with KYC and local laws is critical when using Stripe for marketplaces.

Is PayPal or Stripe better for ecommerce?

Stripe is better suited for scalable ecommerce platforms and marketplaces, while PayPal is ideal for peer-to-peer or small-scale sales. Stripe offers more flexibility, developer tools, and marketplace-specific features like automated payouts and tax reporting—making it the better long-term choice for most WooCommerce marketplaces.

Does Stripe have an ecommerce platform?

Stripe itself is not an ecommerce platform, but it powers payment infrastructure for ecommerce. You can use Stripe with platforms like WooCommerce and WC Vendors to create a full-featured online marketplace with payment collection, vendor payouts, and compliance tools built in.

Why is Stripe shutting down accounts?

Stripe may shut down accounts that violate terms of service, trigger fraud alerts, or fail to meet KYC and tax compliance requirements. For marketplaces, using Stripe Connect with proper onboarding workflows helps reduce this risk. It’s important to verify vendors thoroughly and stay aligned with Stripe’s policies.

Can I pay a vendor through Stripe?

Yes, Stripe Connect for marketplaces allows you to pay vendors directly through automated or manual payouts. You can set payout schedules, send funds in local currencies, and manage compliance requirements through the Stripe dashboard. WC Vendors includes built-in support to make this process even easier for WooCommerce marketplaces.

Can I use Stripe to pay people?

Yes, Stripe can be used to pay people through connected accounts. This includes vendors, freelancers, and service providers. Using Stripe Connect ensures proper documentation, tax reporting, and compliance—ideal for multi-vendor platforms or marketplaces with frequent payouts.

Can you use Stripe to pay for things?

Absolutely. Stripe supports online payments for digital and physical goods, services, subscriptions, and donations. Customers can pay using cards, wallets, and local methods. Stripe’s flexibility makes it one of the most widely used payment processors in ecommerce and online marketplaces.

Can I use Stripe to pay contractors?

Yes, Stripe can pay contractors using connected accounts, especially in marketplaces or platforms that match clients with service providers. If your contractors are part of a marketplace, Stripe Connect is the recommended setup to ensure legal compliance and smooth payment distribution.

Does Stripe charge a merchant fee?

Yes. Stripe typically charges 2.9% + 30¢ per successful transaction in the U.S. Rates vary by country, currency, and payment method. Additional fees may apply for currency conversion, international cards, or Stripe Connect platform usage. These fees are automatically deducted before payouts.